Open Banking – sharing your data and making payments through other providers

How are we doing?

Since 2018, you’ve been able to share your Barclays data with other companies so that you can use their services and make payments through them. For example, you might want to share your Barclays data with a company that lets you operate all your accounts from one place. This is called ‘Open Banking’.

To make sure you’re getting the best service from us when you use Open Banking, we’ve put together the data below, which tells you how well we’re performing. It shows how fast our service has been and whether there have been times when it isn’t available.

The metrics shown below are for the period 01 October to 31 December 2024.

Most of them compare our Open Banking services to our digital banking services. By ‘digital banking services’, we mean Barclays.Net and Barclays iPortal.

Is our Open Banking service available consistently?

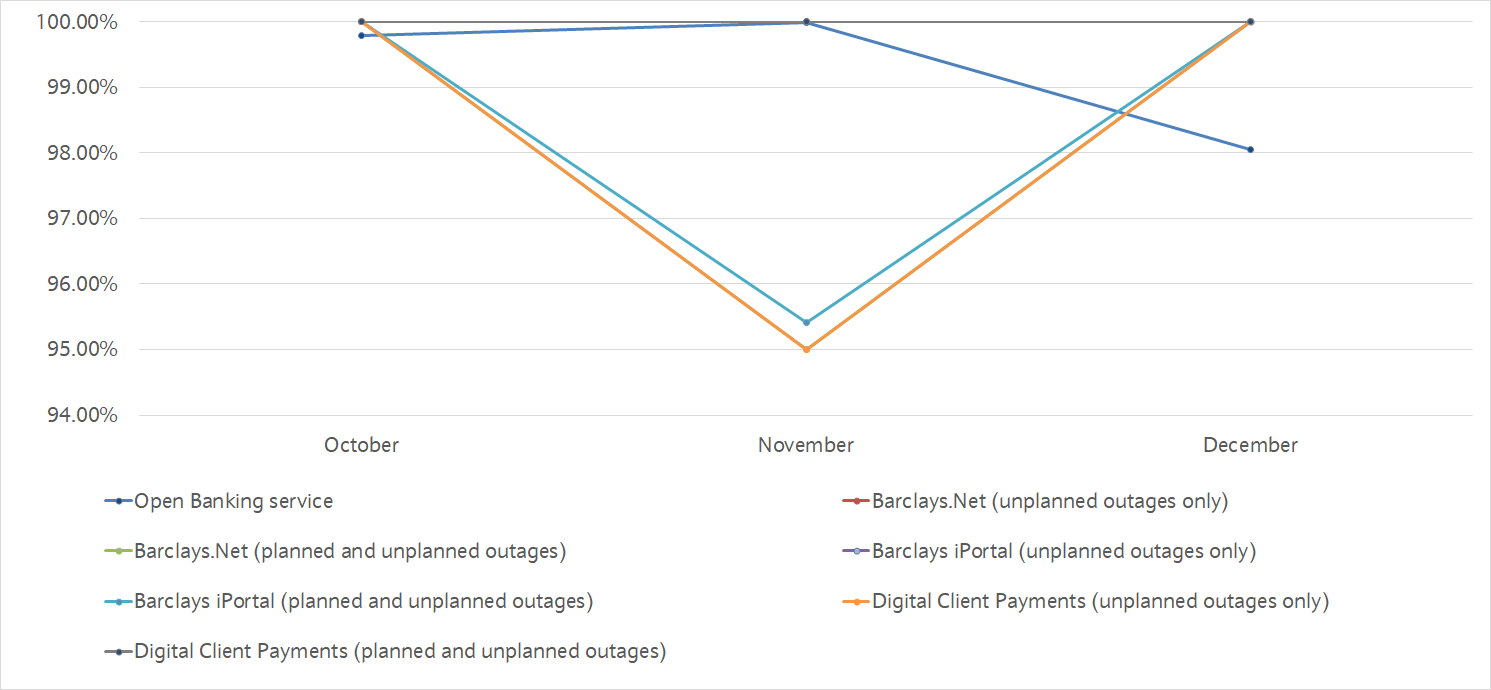

This graph compares the amount of time our Open Banking service was available to the amount of time our digital banking services were available over the last three months.

See the independent service quality survey results for our Personal Current Accounts.‡

| October | November | December | |

| Open Banking service | 99.79% | 99.98% | 98.05% |

| Barclays.Net (unplanned outages only) | 100.00% | 100.00% | 100.00% |

| Barclays.Net (planned and unplanned outages) | 100.00% | 95.00% | 100.00% |

| Barclays iPortal (unplanned outages only) | 100.00% | 100.00% | 100.00% |

| Barclays iPortal (planned and unplanned outages) | 100.00% | 95.42% | 100.00% |

| Digital Client Payments (unplanned outages only) | 100.00% | 95.00% | 100.00% |

| Digital Client Payments (planned and unplanned outages) | 100.00% | 100.00% | 100.00% |

Sometimes we plan outages so that we can release new features or carry out maintenance. We’ve included all the time our Open Banking service and digital banking services weren’t available in the graph, whether or not the outage was planned. We always let our customers know when we’ve planned outages and we give them details of other ways of doing their day-to-day banking.

How quickly are Open Banking payments made, compared to payments made using our digital banking services?

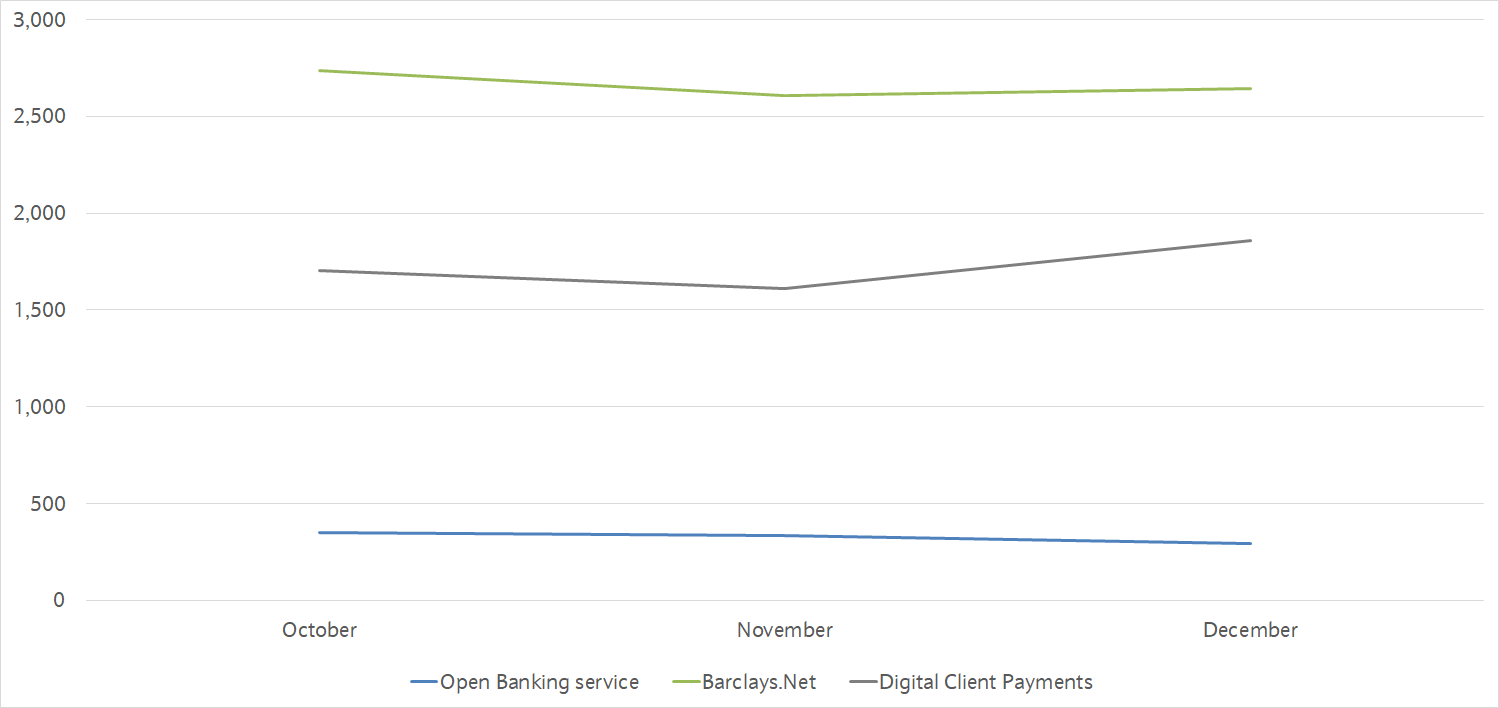

This graph compares the amount of time it took for a company to make an Open Banking payment that you’d authorised to the amount of time it took using our digital banking services.

| October | November | December | |

| Open Banking service | 352 | 335 | 296 |

| Barclays.Net | 2,738 | 2,609 | 2,644 |

| Digital Client Payments | 1706 | 1612 | 1858 |

Account information performance

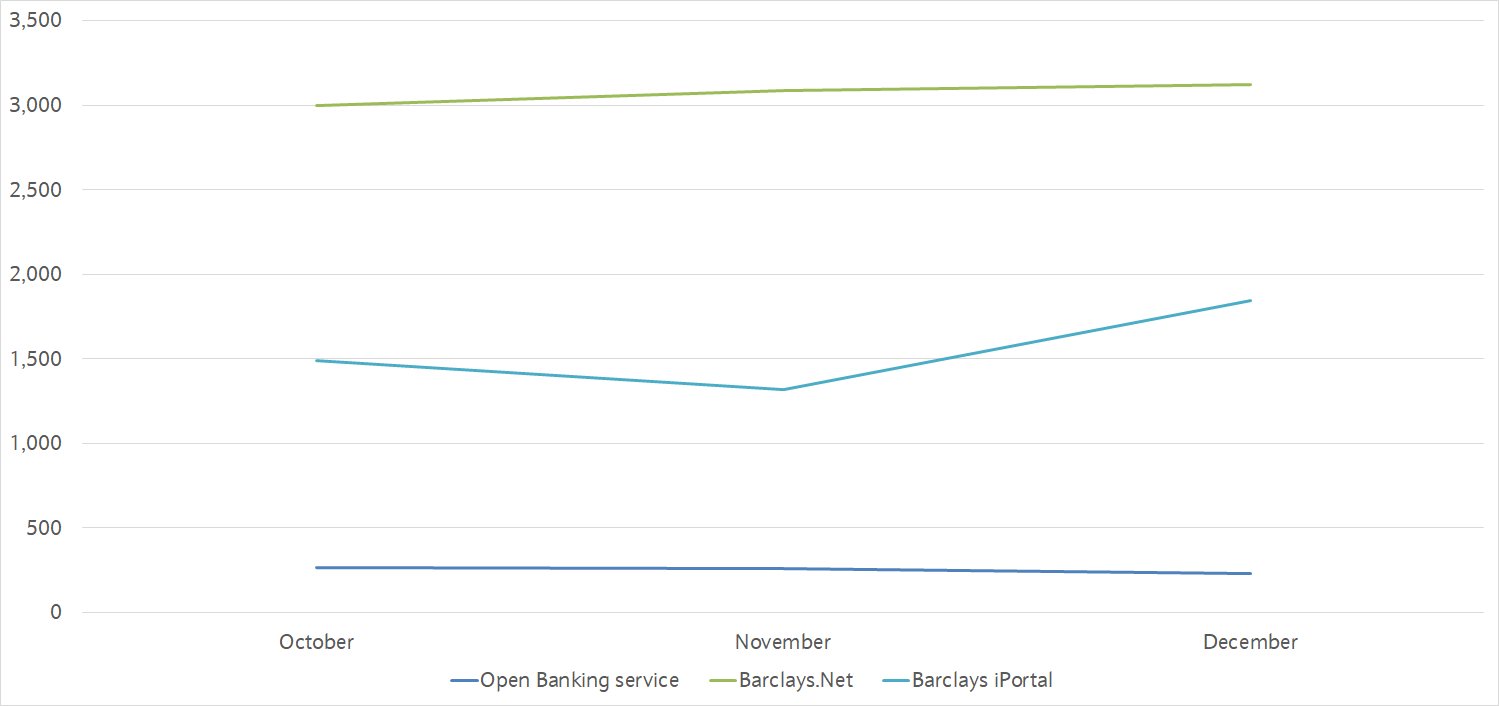

This graph shows how quickly we provided data when we were asked for it by companies you authorised to request it. This is compared to the amount of time it took to access the same information using our digital banking services.

| October | November | December | |

| Open Banking service | 266 | 258 | 227 |

| Barclays.Net | 2,995 | 3,085 | 3,121 |

| Barclays iPortal | 1,487 | 1,316 | 1,846 |

Checking you have enough money available for a payment

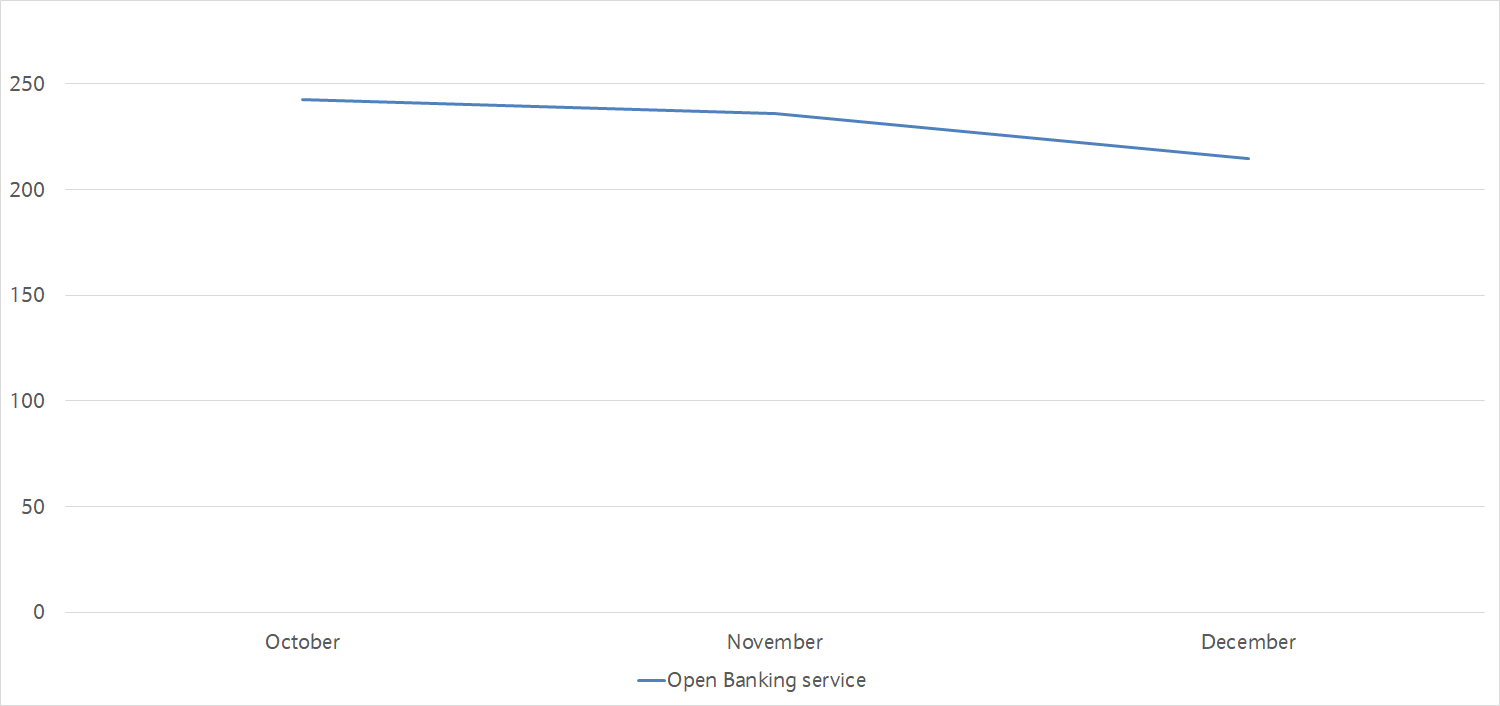

This graph shows how quickly a company you used to make a payment was able to check you had enough money available. This is called ‘confirmation of funds’.

| October | November | December | |

| Open Banking service | 242 | 236 | 214 |

Successful requests from other companies

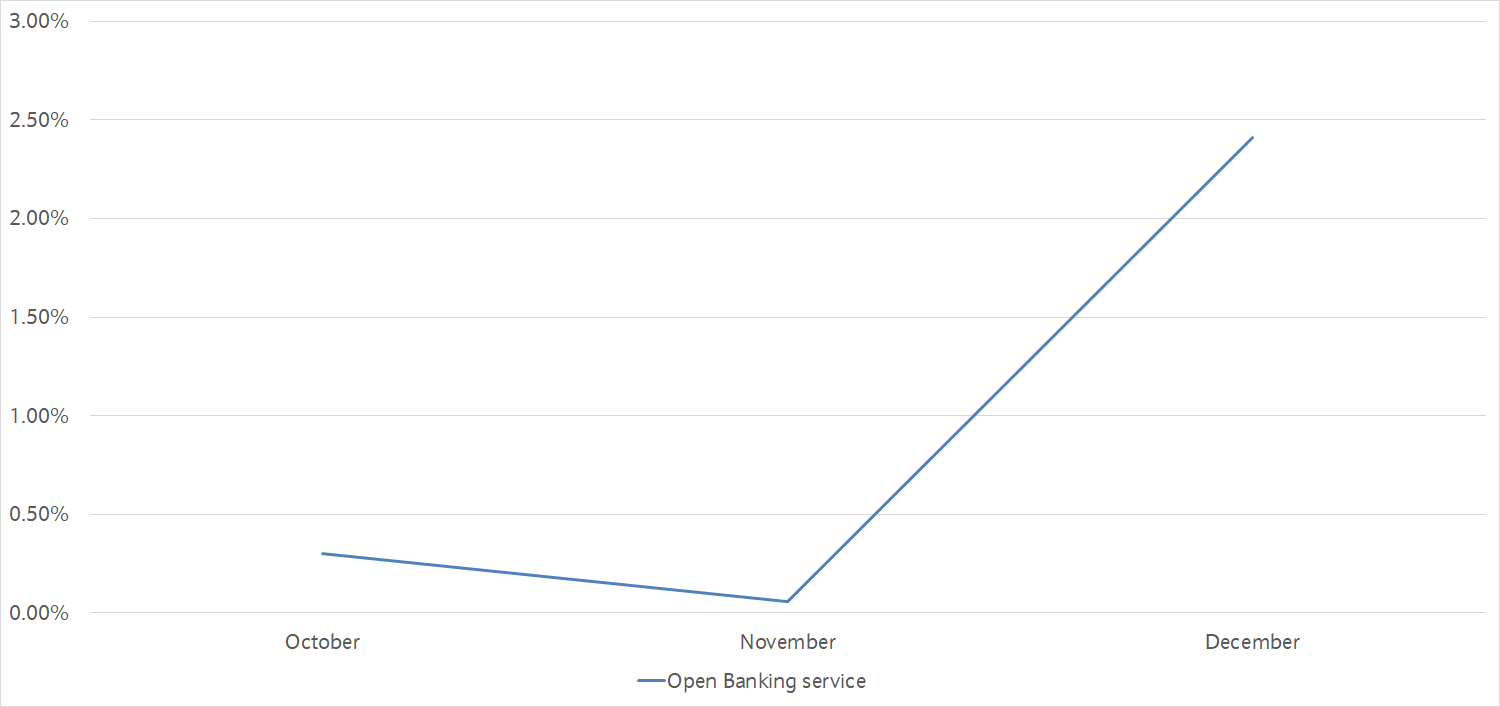

This graph shows the percentage of errors that occurred when we received requests from companies you asked us to share your data with, or that you allowed to make a payment for you or check you had enough money available to make a payment.

| October | November | December | |

| Open Banking service | 0.30% | 0.06% | 2.41% |

See more detailed data

Download information showing how our Open Banking and digital banking services performed every day for the period 01 October to 31 December 2024.